When you hear "ACA plan," you might think of cheap health insurance. But the truth is more complicated. The Affordable Care Act didn’t just make insurance cheaper-it changed what insurance even means. If you’re signing up for a plan on HealthCare.gov this year, you’re not just picking a price. You’re choosing between coverage that covers your diabetes, your anxiety, your pregnancy, or coverage that leaves you paying thousands out of pocket when you need it most.

What ACA Plans Actually Cover (The 10 Essential Benefits)

Before the ACA, insurance companies could sell you a plan that didn’t cover maternity care, mental health visits, or prescription drugs. You could buy a plan that looked cheap-until you got sick. Then you’d find out your "coverage" didn’t mean anything.

ACA plans fix that. Every plan sold on the Marketplace must include ten essential health benefits. That’s not a suggestion. It’s the law. Here’s what’s included:

- Ambulatory patient services (doctor visits)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Laboratory services

- Preventive and wellness services

- Pediatric services, including dental and vision

This isn’t marketing fluff. A 2025 CMS survey found 92% of enrollees with chronic conditions say the elimination of pre-existing condition exclusions was the most valuable part of their plan. If you have asthma, cancer, or depression, you can’t be denied coverage or charged more. That alone makes ACA plans different from anything that came before.

How Metal Tiers Actually Work (Bronze to Platinum)

ACA plans are labeled Bronze, Silver, Gold, or Platinum. That’s not about quality. It’s about how costs are split between you and the insurer.

Here’s what those labels mean in real dollars:

- Bronze: 60% of costs covered by the plan. You pay 40%. Lowest monthly premium, highest out-of-pocket when you need care.

- Silver: 70% covered by the plan. You pay 30%. This is the most popular tier-and the only one that qualifies for cost-sharing reductions.

- Gold: 80% covered. You pay 20%. Higher premiums, lower bills when you visit the doctor.

- Platinum: 90% covered. You pay 10%. Highest premiums, lowest out-of-pocket costs.

Most people choose Silver. Why? Because if your income is between 100% and 250% of the Federal Poverty Level, you qualify for cost-sharing reductions. That means your Silver plan’s deductible and copays drop dramatically. For example, a Silver plan with CSR might have a $500 deductible instead of $3,000. That’s the difference between paying $100 to see a specialist or $1,200.

How Premium Tax Credits Cut Your Bill (And Why They’re Disappearing)

The biggest reason ACA plans are affordable right now? Premium tax credits. These are government subsidies that lower your monthly premium. They’re not a loan. You don’t pay them back-unless your income changes and you don’t update your info.

Here’s the math: A 40-year-old earning $50,000 a year would pay $534 a month for a Silver plan without subsidies. With enhanced tax credits (from the American Rescue Plan), that drops to $247. That’s a $287 monthly savings. Over a year? Over $3,400.

But here’s the problem: Those enhanced credits expire at the end of 2025. The Inflation Reduction Act extended them through this year, but Congress hasn’t acted. If nothing changes, the same person will pay $1,260 more per year. That’s not a small bump. That’s a 114% increase. For a 60-year-old in some states, it’s worse-up to 192% more.

And it’s not just about income. The ACA’s original 400% FPL cap on subsidies is gone-for now. That means even people making $60,000, $70,000, or more can get help. But that’s temporary. Starting in 2026, subsidies will revert to the old rules. That could push millions off the Marketplace.

The "Family Glitch" Fix That Changed Everything

Before 2023, if your employer offered you insurance-even if it was unaffordable for your whole family-you couldn’t get Marketplace subsidies. That was called the "family glitch." Millions of spouses and kids were locked out.

The fix? Now, if your employer’s plan costs more than 9.12% of your household income for family coverage, your spouse and kids can qualify for subsidies-even if your individual coverage is cheap. That opened the door for over 3 million people to get affordable coverage in 2024.

It’s a small change with huge consequences. A teacher in Texas making $45,000 might get cheap coverage for herself, but her husband and two kids couldn’t join her plan without paying $1,800 a month. Now, they can get a Silver plan with tax credits for $200 a month. That’s life-changing.

What ACA Plans Don’t Cover (And Why Networks Matter)

Just because a plan covers "essential health benefits" doesn’t mean you can see any doctor. ACA plans use narrow networks to keep premiums low. You might think you’re getting "comprehensive" coverage-until you find out your favorite specialist isn’t in-network.

Check your provider list before you enroll. If you see a cardiologist every six months, make sure they’re in the plan’s network. If you take a brand-name drug for diabetes, check the formulary. Some plans put high-cost drugs in the highest tier, meaning you pay 40% of the cost.

Medicare Advantage plans often have lower out-of-pocket maximums ($8,300 in 2025) than ACA plans ($9,450). That’s a real difference if you’re facing a major illness. ACA plans are great for prevention and routine care. But if you have a chronic condition requiring frequent hospital visits, the cap matters.

Who Gets Left Behind?

The ACA helped millions-but it’s not perfect. There are still gaps.

First, Medicaid expansion. In states that didn’t expand Medicaid (like Texas, Florida, and Georgia), people earning below the poverty line get nothing. They earn too much for Medicaid, too little for subsidies. That’s a coverage gap. About 1.7 million people are stuck there.

Second, the DACA recipient cutoff. Starting in 2026, undocumented immigrants with DACA status will no longer be eligible for Marketplace coverage. That affects around 550,000 people. Many have been on ACA plans for years. They’ll lose coverage unless Congress acts.

Third, the income cliff. If you make $51,000 instead of $49,000, you might lose $4,000 in subsidies. That’s a real penalty for earning more. The system doesn’t phase out gradually-it drops off a cliff.

Real People, Real Stories

Sarah K., a freelance writer in Ohio, earns $32,000 a year. She gets a $0 premium Silver plan with full cost-sharing reductions. Her deductible is $500. Her copay for a doctor visit? $15. She’s never paid more than $200 out of pocket in a year.

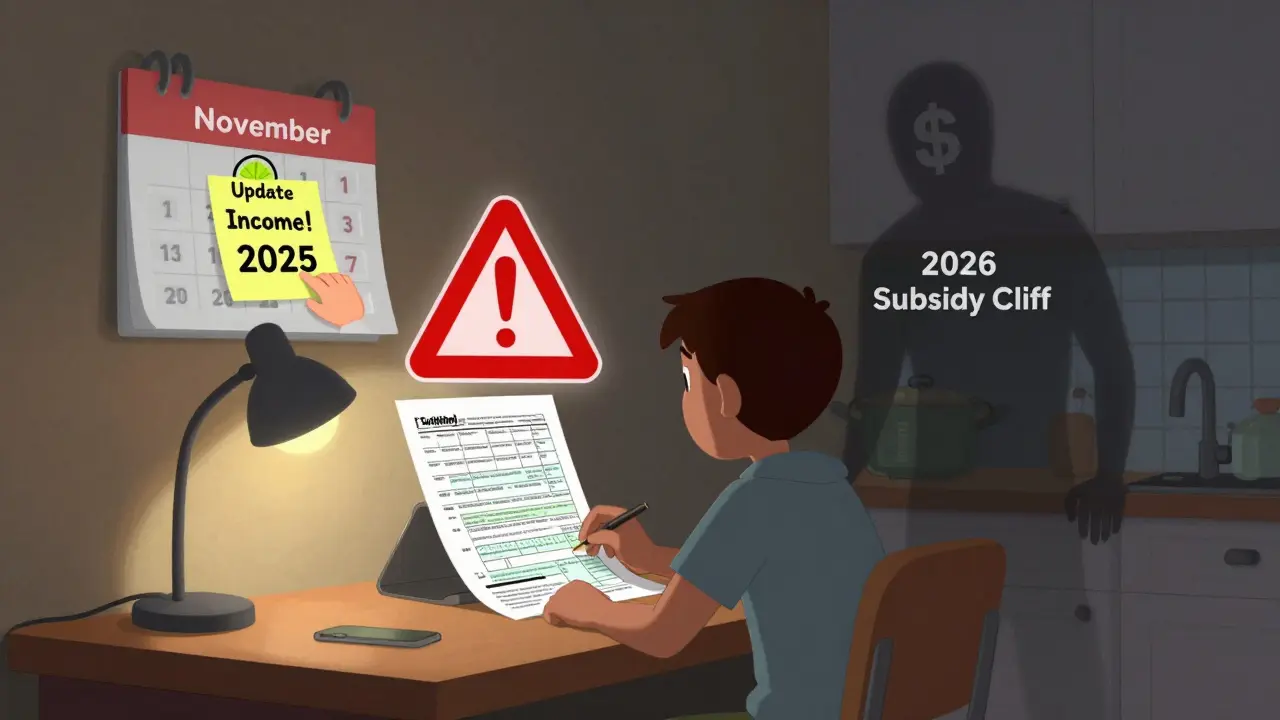

But u/ACA_Warrior on Reddit had a different experience. Their income dropped 30% mid-year. They didn’t update their income on HealthCare.gov. When they filed taxes, they owed $2,800 in repayment for subsidies they didn’t qualify for. They had to pay $2,800 in medical bills they didn’t expect.

That’s the hidden cost of the system: reconciliation. If your income changes, you must report it. Most people don’t. The CMS 2025 survey showed only 42% of users understood how cost-sharing reductions worked. And 58% of negative reviews on Trustpilot mention "unexpected tax bills."

What You Need to Do Now

If you’re on an ACA plan, here’s what you need to do before December 31, 2025:

- Log into HealthCare.gov and check your subsidy amount. If it’s based on the enhanced credits, it’s going away.

- Compare 2026 plans. Look at premiums, deductibles, and networks-not just the monthly price.

- Update your income. Even if you think you’re fine, a raise, bonus, or side gig can change your subsidy.

- Check your prescription drugs. If your medication moved to a higher tier, your cost could double.

- Don’t wait until December. Open enrollment starts November 1, 2025. Plans change fast.

For those who qualify for Medicaid, apply now. In expansion states, Medicaid offers better coverage than any Marketplace plan. In non-expansion states, look for local community health centers. They offer sliding-scale care regardless of insurance.

The ACA didn’t fix healthcare. But it made it possible for millions to get coverage without going broke. The question now isn’t whether you can afford a plan. It’s whether you can afford to lose it.

Do ACA plans cover pre-existing conditions?

Yes. Under the Affordable Care Act, insurance companies cannot deny coverage, charge more, or refuse to pay for treatment because of a pre-existing condition like diabetes, cancer, asthma, or depression. This rule applies to all Marketplace plans and has been in effect since 2014.

Can I get help paying for my ACA plan?

Yes, if your household income is between 100% and 400% of the Federal Poverty Level, you qualify for premium tax credits that lower your monthly bill. If your income is below 250% FPL, you may also qualify for cost-sharing reductions that lower your deductible and copays. These subsidies are available through HealthCare.gov during open enrollment.

What’s the difference between Bronze, Silver, Gold, and Platinum plans?

These tiers reflect how much of your medical costs the plan covers. Bronze plans cover 60%, Silver 70%, Gold 80%, and Platinum 90%. Lower-tier plans have cheaper monthly premiums but higher out-of-pocket costs when you use care. Silver plans are the only ones eligible for extra cost-sharing reductions if your income is low enough.

Why are ACA premiums going up in 2026?

Enhanced premium tax credits, introduced during the pandemic and extended through 2025, are set to expire. Without them, average premiums will rise by 114%. For older adults, increases could reach 192% in some states. The 2026 plan year will also revert to pre-2021 subsidy rules, reducing financial help for millions.

Can I get an ACA plan if I’m self-employed?

Yes. Self-employed people can enroll in ACA plans and qualify for subsidies based on their Modified Adjusted Gross Income (MAGI). Many self-employed individuals get $0 premiums with Silver plans and cost-sharing reductions. However, estimating income can be tricky-errors in reporting can lead to tax penalties, so it’s important to update your income if it changes during the year.

Do ACA plans cover dental and vision for adults?

Pediatric dental and vision are required benefits for children under 18. For adults, dental and vision coverage is optional. Some Marketplace plans include adult dental or vision as add-ons, but most don’t. You can buy separate standalone dental plans through the Marketplace if needed.

What happens if my income changes during the year?

You should update your income on HealthCare.gov as soon as possible. If your income drops, you may qualify for more subsidies. If it rises, your subsidies may decrease. If you don’t update it and your income ends up higher than estimated, you may owe money when you file your taxes. Starting in 2026, quarterly income updates will be required to reduce these errors.

13 Comments

Stephen Tulloch

Bro this is the only reason I didn't move to the US 🤡 I got free mental health care in Toronto and my asthma meds cost $5. Here you guys treat healthcare like a casino and wonder why people are broke. 🤦♂️

Bianca Leonhardt

People still don't get it. The ACA didn't fix anything. It just made the insurance companies richer by forcing everyone to buy overpriced plans. If you're not rich, you're just paying for the privilege of being denied care later.

Riya Katyal

Oh sweetie you think $500 deductible is good? My cousin in Mumbai pays $2 a month for full coverage including CT scans. You're paying for a luxury spa with a side of bankruptcy.

Melodie Lesesne

I'm so glad I found this. I was terrified to sign up last year but now I get it. My Silver plan with CSR saved me when I broke my ankle. Only paid $20 for the ER. Honestly? I'm kinda emotional right now. Thank you for explaining this so clearly.

Rob Deneke

Update your income people dont wait till tax season. I got a side gig last year and forgot to update and got hit with a $1500 bill. Not fun. Just log in and click the button its 2 minutes

Travis Craw

i never knew about the family glitch fix. my wife and kids were stuck until last year. now we get a plan for $180 a month instead of $1400. i dont even know how to say thank you

brooke wright

I'm a single mom with two kids. My plan covers my son's autism therapy and my daughter's braces. But I just found out my endocrinologist left the network. Now I have to drive 90 minutes. That's not healthcare. That's a road trip with anxiety.

Nick Cole

I was diagnosed with MS last year. I thought I was done. Then I got my ACA plan. No denials. No lifetime caps. I can afford my meds. I can see my neurologist. I'm alive because of this. Don't take it for granted.

kanchan tiwari

THEY'RE COMING FOR THE SUBSIDIES NEXT. THEY'RE JUST WAITING FOR YOU TO STOP PAYING ATTENTION. THIS IS A SLOW-MOTION COUP D'ETAT AGAINST THE POOR. THEY WANT YOU TO BE TOO TIRED TO FIGHT. THEY WANT YOU TO BE TOO SCARED TO ASK FOR HELP. THEY WANT YOU TO DIE IN THE WAITING ROOM AND CALL IT YOUR FAULT.

Bobbi-Marie Nova

I used to think ACA was just a government handout. Then I needed chemo. Now I call it my lifeline. And yeah the premiums are gonna jump. But if you're reading this? You're not alone. We got this.

john Mccoskey

Let’s deconstruct the mythos of the ACA. The 10 essential benefits are a regulatory illusion. They create a false sense of universality while the underlying market remains a predatory structure. The metal tiers are a behavioral nudge designed to exploit cognitive dissonance - you believe you’re getting value because you pay less upfront, but the true cost is externalized into catastrophic risk. The subsidy cliff isn’t a flaw - it’s a feature. It incentivizes income suppression. The family glitch fix? A temporary bandage on a systemic amputation. The real problem isn’t affordability - it’s the commodification of biological survival.

Samyak Shertok

Oh so now we're supposed to be grateful because they let us buy a lottery ticket that might pay out if we don't get sick? Meanwhile, my cousin in Germany gets a doctor in 15 minutes, zero paperwork, and his insulin costs $10. This isn't healthcare. It's a rigged game where the house always wins.

Joie Cregin

I cried reading Sarah’s story. I’m her. I’m the freelance writer with the $0 premium plan. My dog got sick last month - vet bill was $800. I didn’t panic. I just paid it. That’s the magic. Not because I’m rich. Because the system didn’t let me fall. Don’t let them take this away. I’m not ready to be scared again.